2023 paycheck calculator

Use this simplified payroll deductions calculator to help you determine your net paycheck. Terms and conditions may vary and are subject to change without notice.

Texas Paycheck Calculator Adp

To receive a bigger refund adjust line 4c on Form W-4 called Extra withholding to increase the federal tax withholding for each paycheck.

. San Francisco Income Tax Information. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. Start filing your tax return now.

As you consider your employment opportunities with our institution we encourage you to take the time to learn about the university community and how it distinguishes us from other places of employment. You should enter figures that are appropriate to your individual situation. You must follow these instructions to view the FY 2023 rates.

Future costs and financial aid estimates are subject to change. The results provided by this calculator are also intended for illustrative purposes only and accuracy is not guaranteed. Earnings statements W2 forms recent paycheck stubs Important NotesCaveats.

In the event of a conflict between the information from. Looking at the tax rate and tax brackets shown in the tables above for Rhode Island we can see that Rhode Island collects individual income taxes similarly for Single versus Married filing statuses for example. Otherwise the search box only returns current FY 2022.

Paycheck Calculator non-exempt Contact. Rhode Island Tax Brackets 2022 - 2023. Payment estimates are provided for the program years from 2019 to 2023.

Air Force Recruiting Service recruiters will lose 75 in special duty pay each month for fiscal year 2023. The current calculator is not set for a leap year. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

Try our FREE income tax calculator. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Fiscal Year 2023 beginning July 1 2022 is not a leap year.

Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments. LMU is a unique and rewarding place to work. My Paycheck Pay Calendars My Finances Ordered Deductions.

On the next page you will be able. FY 2023 Per Diem Rates Now Available Please note. Please select Full Year under the month drop down list if you would like a snapshot of Pay Schedules and Pay-dates for the whole year.

To fatten your paycheck and receive a smaller refund submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal income tax withholding. The Gardner Payment Calculator provides estimates of expected payments and likelihood of payments for ARC-CO and PLC. We can also see the progressive nature of Rhode Island state income tax rates from the lowest RI tax rate bracket.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Cost of attendance and calculations are currently based upon 2022-2023 figures. Important note about this calculator.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. This calculator will provide a preliminary estimate of federal state and institutional aid eligibility. The FY 2023 rates are NOT the default rates until October 1 2022.

Select FY 2023 from the drop-down box above the Search By City State or ZIP Code or Search by State map. Users can select the state county and crop combination that they wish to consider. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie.

Information for Michigan State Universitys Controllers Office. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. You can use our free Michigan income tax calculator to get a good estimate of what your tax liability will be come April.

The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. The figures entered on the input page of this calculator are for hypothetical purposes only. Why Gusto Payroll and more Payroll.

Use this pay calculator to calculate your take home pay in Australia. TAX DAY IS APRIL 17th - There are 213 days left until taxes are due. PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 20212022 and current 20222023 financial years.

Projected 2023 Va Disability Pay Rates Cck Law

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

General Schedule Gs Base Pay Scale For 2022

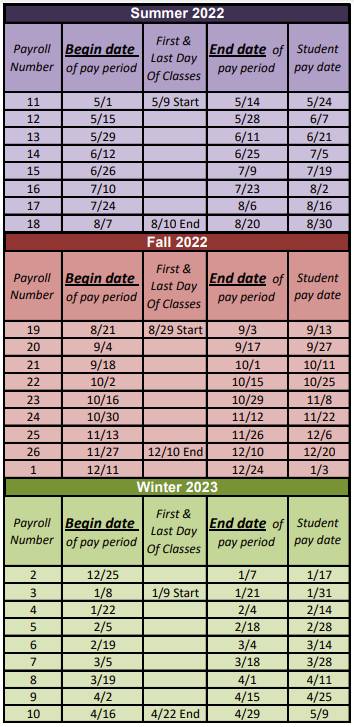

Pay Periods And Pay Dates Student Employment Grand Valley State University

2022 Military Pay Dates Military Com

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Payroll Calendar Los Angeles City Controller Ron Galperin

Ts Prc Calculator 2023 For Teachers Employee Salary With New Fitment

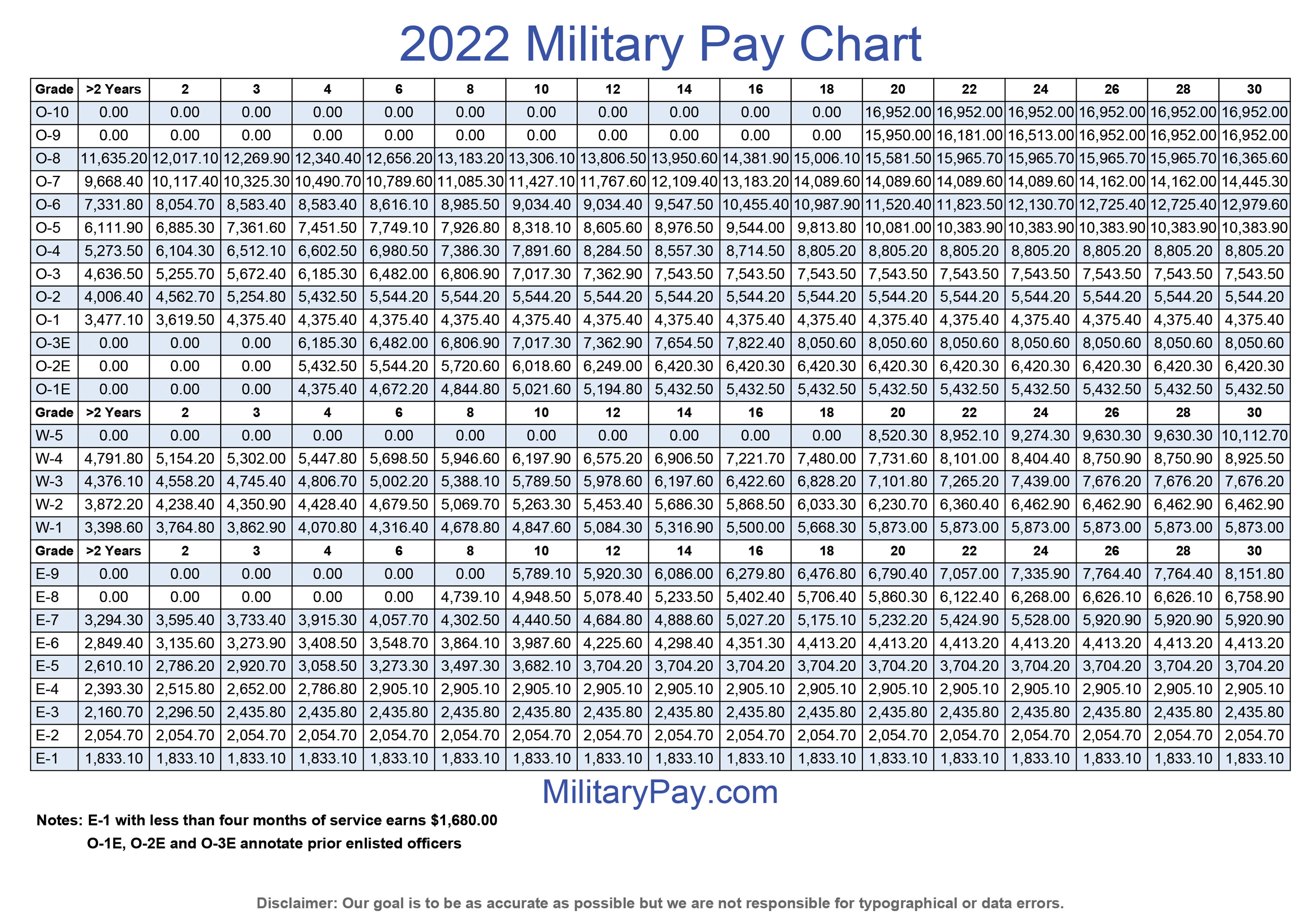

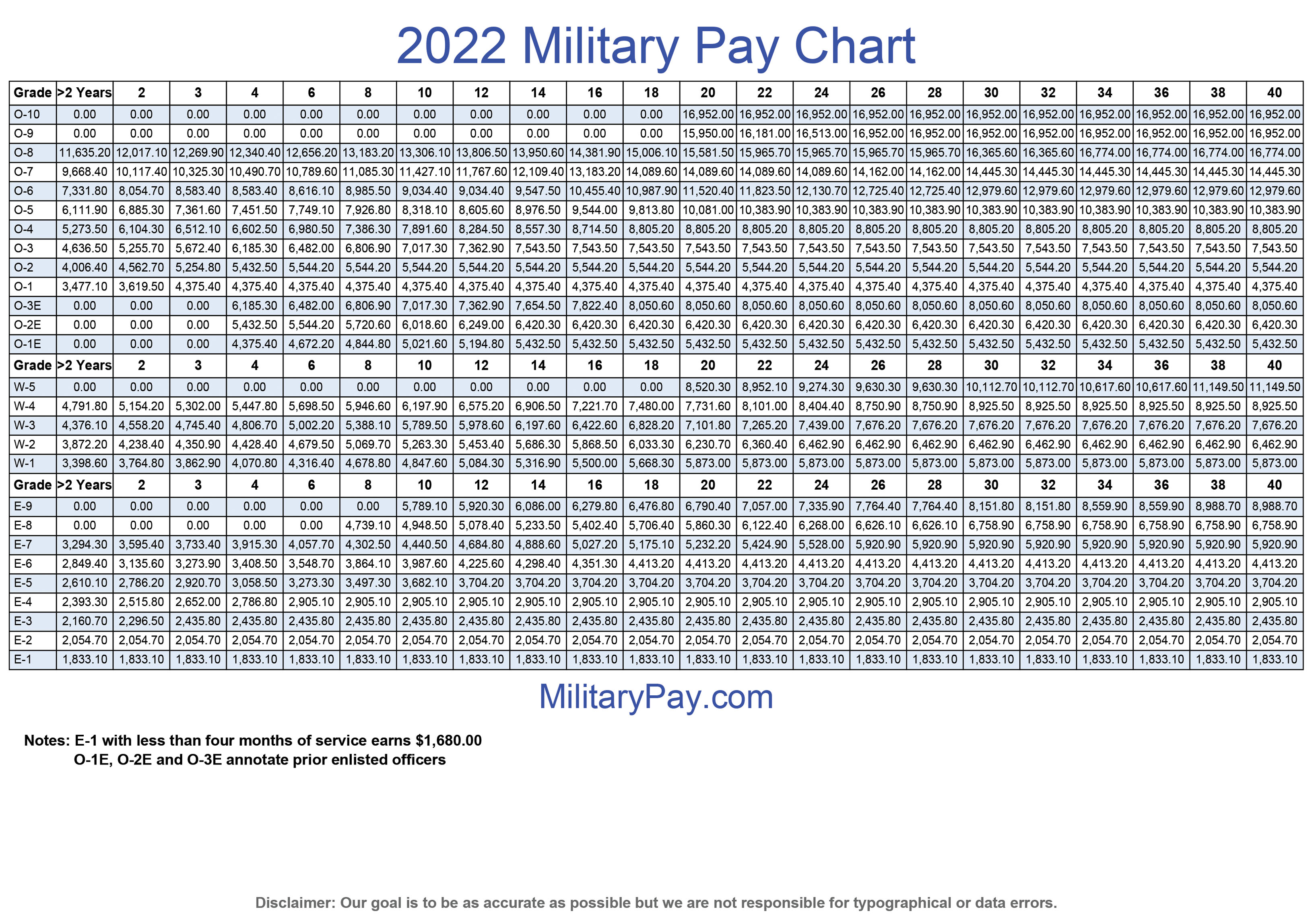

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

Projected 2023 Va Disability Pay Rates Cck Law

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Ptu Pay Schedule

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

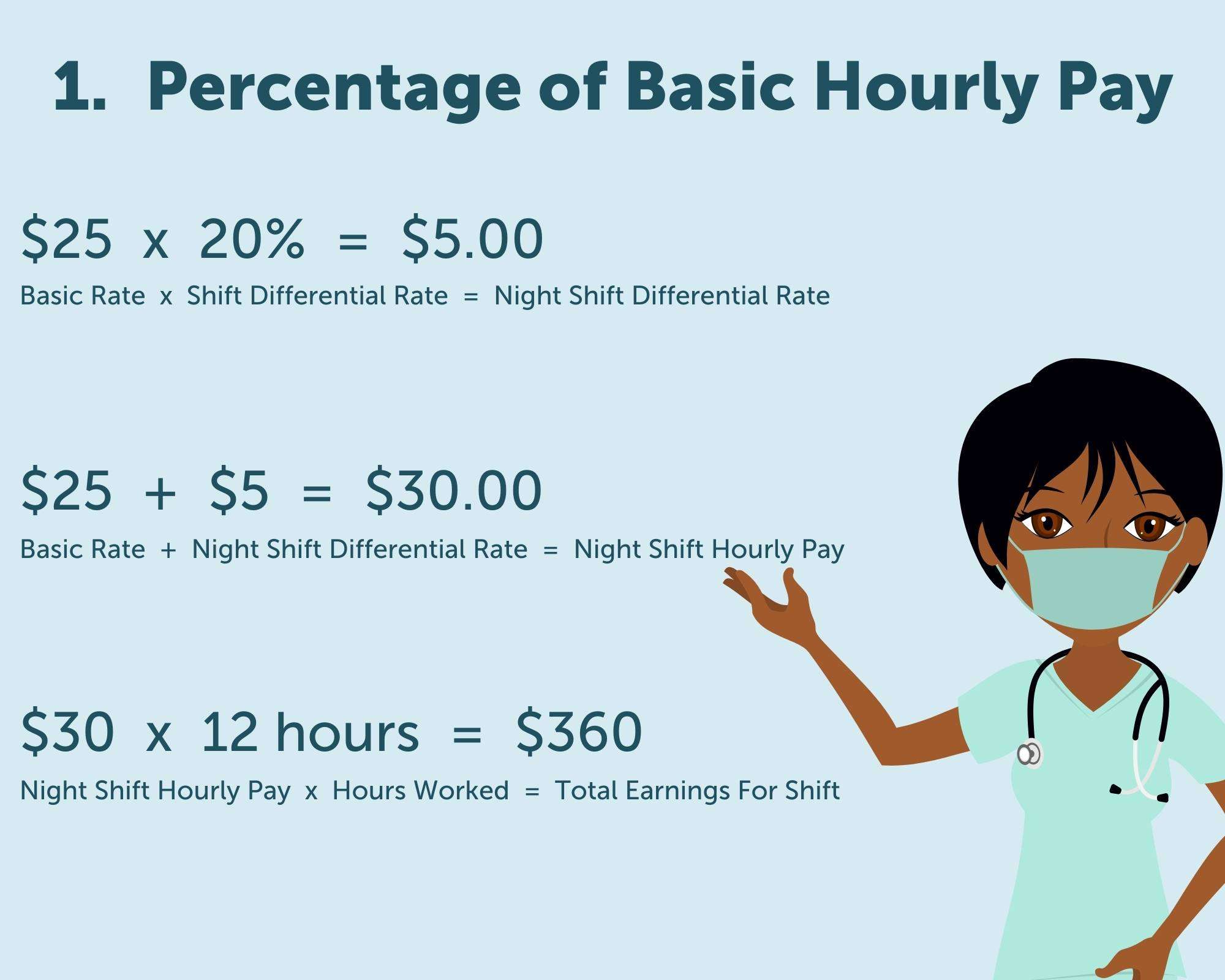

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale